Manosphere misogynists love fantasizing about a coming apocalypse, invariably caused by the bad behavior of feminists and/or women in general, and invariably resulting in feminists and/or women in general lost and forlorn and realizing their mistakes, returning to men begging for help and asking for forgiveness. Like Doomsday Preppers waiting for the planet to suddenly shift on its axis due to the sudden reversal of the magnetic poles, most of the apocalyptic misogynists don’t seem to have the faintest idea of what they’re talking about.

Take, for example, one Paul Elam of A Voice for Men, who transformed himself into an environmentalist last week when he realized it would give him an excuse to rant about the evils of women spending money. Turns out that the “conventional wisdom” his thesis depends on — that women are responsible for 80% of spending — is essentially an urban legend, and that men and women seem to spend roughly the same amounts. Similarly, there’s evidence that suggests men and women in developed countries have similar “carbon footprints,” with men if anything a bit more pollutey.

But of course this is hardly the only bit of apocalyptic misogynistic fantasy that, upon examination, turns out to be based on patent nonsense. Manosphere misogynists – particularly those on the racist right – love to complain about the evils of single motherhood, especially in the “ghettoes,” which they imagine will lead to crime rates spiraling out of control, riots, dogs and cats living together, and any number of other apocalyptic scenarios.

As one commenter on Dalrock’s manosphereian blog put it, providing a pithy summary of the coming single-mom apocalypse:

Single mothers bring the very wellfare state they depend on closer to the brink of colapse with every illegitimate child they pop out, who will most likely in turn create more bastards and be more likely to commit crimes thus placing an ever increasing strain on the state’s purse stings. …

[T]hings will collapse soon enough and then it will be everyone for themselves. No more suckling at the government’s saggy dried up teet.

Of course, manospherians are hardly the only ones who like to blame single moms for everything. You may recall that odd moment in the presidential debates when Mitt Romney responded to a question about gun violence with “gosh to tell our kids that before they have babies, they ought to think about getting married to someone, that’s a great idea.”

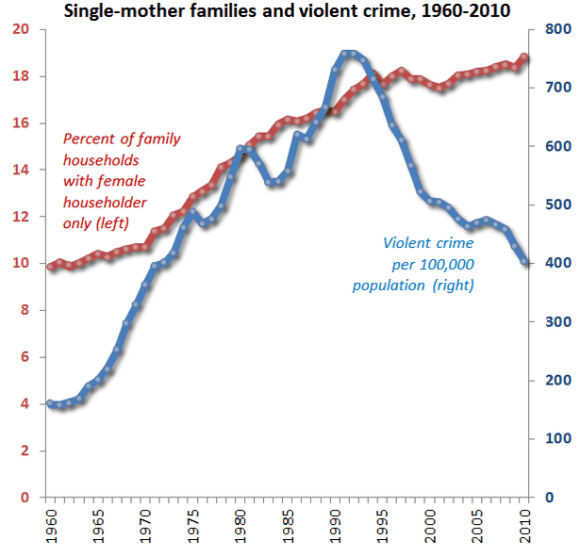

There’s just one tiny problem with the whole single-motherhood-means-higher-crime-rates argument: if you look at the history of the past twenty years or so you will find that while single motherhood has been on the increase, violent crime rates have been going down, down, down. Take a look at this chart, which I have borrowed from an excellent post on The Atlantic by University of Maryland sociologist Philip Cohen.

Huh. First single motherhood and crime rise together, then crime plummets while single motherhood continues to rise. It’s almost as if the two social trends have no correlation with each other at all.

As Cohen writes:

Violent crime has fallen through the floor (or at least back to the rates of the 1970s) relative to the bad old days. And this is true not just for homicide but also for rape and other assaults. At the same time, the decline of marriage has continued apace. Looking at two aggregate trends is never enough to tell a whole story of social change, of course. However, if two trends going together doesn’t prove a causal relationship, the opposite is not quite as true. If two trends do not go together, the theory that one causes the other has a steeper hill to climb. In the case of family breakdown driving crime rates, I don’t think the story will make it anymore.

Once upon a time, when both single motherhood and crime rates were moving upwards, you couldn’t entirely blame some social critics for suggesting there might be some connection. But with twenty more years of data we can see clearly that this just isn’t so. At this point, anyone predicting a single mother crime apocalypse is either a) an ideologue, b) ignorant about the facts or c) both.

In the case of the apocalyptic manosphere ranters, it’s obviously c.

Also this:

is absolute bullshit. Education and economic opportunity have been proven to reduce the number of children that women have and delay the age at which they begin to have them. There are in fact single mothers who are poor and supplement the cost of raising* children with government programs. And thank goodness for that. But there are also married and/or intact couples that are poor and supplementing the cost of raising children with government programs.

And, your non-sequitor about “student debt” aside, you know perfectly well that there are single mothers who may struggle financially but are not using any of the government programs that supplement the cost of raising children. You’re bullshit attempt to conflate “illegitimacy” and single motherhood is just another example of your intellectual dishonesty.

Spoos: That didn’t work out too well for most of the economies that tried in the ’30s.

Wrong.

The countries that went for “austerity” suffered. Those who didn’t, did alright. France unpinned it’s economy, and printed money. Economy did alright.

Britian did the same, economy started to recover; repinned the money to gold; contraction.

US was spending: in recovery, stopped spending in 1936, second depression in 1937.

Germany… hyperinflation because of Debt Repayments imposed by Versailles.

Here’s someone else talking about it: Stunning cost of bad economic ideas in the 1930s and today

There isn’t really a good long-term answer to the cycle of boom and bust other than letting it happen; the U.S. has had an economic crisis about every 40 to 50 years, some more severe than others.

Regulation. We had large cycles, before the banking reforms of the 1930s. We had minor ones until the 2000s. In the middle ’90s the bankers convinced people the “problems of capitalism” have been fixed, and got the regulations eased. It all went nuts. The previous failure (S&Ls) was the same pattern.

And your example of Tulipmania is the same. The common element in it (and the South Sea Bubble, and the CDS/CDO issue, and the S&Ls) was that the people with money stopped investing it in things, and started investing it in other money.

It’s very much a correctable issue: you don’t let investment houses play with deposit capital. You make them solicit gambling capital.

I don’t have an issue with the state subsidizing family planning, in fact, I’m a strong proponent for it, but I do not believe that the current trend of (de facto) reproductive subsidy is sustainable, let alone desirable.

Right… so the kids need to suffer, which costs society more (in crime, in people who are marginal in the economy, in strains on the schools, and the emergency rooms).

All so you can feel you are “properly” discouraging people to not have sex.

Then again, the numbers you cite don’t mean quite say the do. My ex’s sister had an “unplanned” pregnancy, of the type in your study. She and her partner decided, one night to forgo the condom. She got pregnant.

That would come up in your survey. What did it mean? It means they had the child they were thinking about having about a year before they thought they were going to.

Oh! the Moral Failing, take me to my fainting couch and fetch me my salts!!!!

I just want to know if he’s also going to sites like Roissy’s and Roosh’s and lecturing the young men there about their desire to go “raw dog” as often as possible. Does he go on the sites where men complain about the cost of their child support and pull this insipid finger-wagging routine about responsibility?

I’m mot going to fade that bet.

More education is not necessarily going to help reduce this issue, as illegitimacy is currently trickling up the socioeconomic ladder. A single-income household is even harder to keep afloat in the face of undischargeable student debt.

This is appallingly conflationary (which is no surprise, given the depth of his apparent understanding of economics).

There is nothing to show (certainly not in that sentence) that single parents who are so by choice are doing it in the face of, “undischargeable student debt”.

It’s also question begging, in that it presumes the only solution is to make it even harder to raise a child on a single income; rather than making substantive changes to the issue of student debts.

It really looks (big surprise coming, better sit down) that Spoos is arguing in bad faith.

In March of 1933, when the U.S. unpinned from the gold standard, the dollar dropped overnight by 5%. The reason it didn’t drop more was that many other currencies had also unpinned from the dollar, and all the confiscated gold was used to keep the dollar stable in the international market.

If you don’t go by the CPI (consider that productivity increases and cheap imports from countries with devalued currencies suppress inflation as measured by the CPI), the real purchasing power of the median wage has dropped precipitously. People with average incomes are no longer able to afford average houses, and the only thing that keeps the whole circus going is inflation to the tune of a twenty-fold decrease in the purchasing power of a dollar over 70 years, which has encouraged massive public and private debts, very little of which are actually collectible now.

Liquidity traps: The reason solid fiscal stimulus is unpalatable is that the government has already shot its wad on the bailouts, and managed to decrease its bond rating doing so. The huge national debt, fueled by inflationary spending (by means of printing more money), has reached a point where interest payments alone are a substantial (and growing) fraction of the budget. Sooner or later, that crow is coming home to roost, and when it does, things will start to get really bad.

Personally, I think a mixed precious metal standard strikes a nice balance between the sharp downturns of gold-standard economies (though the Austrian argument that inflation-fueled malinvestments caused the 1929 crash is persuasive) and the runaway inflation which is the common endpoint of fiat currencies.

In hidsight, how did monetary inflation help?

We’ve gotten ourselves into a bigger and more inextricable mess. But, hey, the economy’ll perk up in the event of another major war, right?

I would argue that the redistribution of wealth from savers to debtors and consumers accomplished by inflating fiat currency is not, in the long run, at all healthy for society.

I don’t think I’ve ever heard a guy I know espouse condomless sex if the woman wasn’t on BC. Nor have I really seen it advocated by people I don’t. Most guys on the Internet who are into sport-fucking really don’t want to have kids.

I’m also unsure how, if I support government subsidy of contraceptives, how I am trying to stop people from having sex. It’s not the sex that bothers me, it’s paying for the resultant children.

It is my view that people who cannot afford to support kids should not have them. And that the government should not encourage people to do so by paying more for every additional child; that’s how you get people like Octomom (and a decent number of fundamentalist Mormon polygamists, too) bilking the welfare system until it no longer works. Sure, that sounds horrible, but if the system collapses, no one will be helped by it. I don’t want people to starve, but I think that Malthusian catastrophe is always a step away. Civilization is a very thin veneer over the nasty, brutish, and short Hobbesian struggle.

Aw, lookit. Another goldbug.

Spoos, you do realize that “fuck you, Jack, I got mine” fairly reeks as social policy, right?

Dear trolls – if you can’t be interesting can you at least be succinct? Please?

Oh Spoos… Now that you’ve (officially) outed yourself as a goldbug…

the position in the business cycle affects the impact of fiscal policy on output: on average, government spending, and revenue multipliers tend to be larger in downturns than in expansions. This asymmetry has implications for the choice between an upfront fiscal adjustment versus a more gradual approach. (IMF Working Paper).

If you skip to the end (where the pictures are) you see that stimulous spending is far more efficient at reinvigorating an economy that reducing expenditures.

Liquidity traps: The reason solid fiscal stimulus is unpalatable is that the government has already shot its wad on the bailouts

No, it’s more because people confuse what’s going; mostly from an inability to see the macroeconomic picture in a comprehensible way.

(that metaphor, by the way, comes by way of Milton Friedman, you might have heard of him).

But you, you know more than they do… because you believe in the myth of, “instrinsic value”, never mind that all currency is fiat. Gold/silver/platinum, as abstract objects don’t mean anything. For an economy to really function the value of the coinage must be higher than the value of the metal. And, where the money is as valuable as the metal, coins will be clipped (England had millions of £s lost in this way: see “Newton and the Counterfeiter”).

You, of course, disagree. Never mind that concrete standars lead to inflexible response, and longer; more dramatic, depressions. What “hard” currencies are really good for, is creating debt. Which is really good for creating income inequality.

Which is, in plainer english, “Fuck you Jack, I got mine.”

Wait did you just use Nadya Suleman as an example of people having too many babies because the government incentivizes it?

Wow, I had no idea that you could plan to have octuplets, since that is what you’re implying. That is a neat trick!

Also, dude, talking about economic policy and then saying that a good solution is ordinary people doing a thing they’re doing ‘wrong’ right now is disingenuous. If you’re talking about systemic problems, you have to talk about system-based solutions. You don’t get to be like “I think that the only economic model I can support is welfare queens pumping out fewer babies” and have anyone take you seriously.

http://www.msnbc.msn.com/id/43241012/ns/health-health_care/

Nadya Suleman’s fertility doctor had his license suspended because he implanted 12 embryos in her uterus, 6 times the number recommended for IVF. Yes, she was trying to have a whole bunch of kids at once. Was she planning for eight? Probably not, but she was definitely looking for more than one.

Agreed, however, that there are many more structural problems with the economy than ‘welfare queens.’ I would like to see a society where debt was not incentivized over saving and hiring employees was encouraged more than stock speculation. I think that restoring the pre-Reagan capital gains tax would be a decent start, and payroll tax cuts are be preferable to income tax cuts. I would like to see an economy where the way forward is not limited to governments printing more money to ease their debt burden, where people do not live their entire lives in economic thrall to usurious credit card rates. I would like to see a society where more people are able to afford to have children, and own a home, without government support.

A rising tide lifts all ships.

@pecunium: But when has the U.S. actually followed Keynesian spending programs? Sure, we do increase government spending in times of depression, but how much of that is targeted at infrastructure, or really anything other than pouring money into a hole, as per the bailouts? There’s also the fact that we don’t decrease spending in times of plenty, or increase taxes to pad a rainy-day fund. Keynesian stimulus on borrowed money (instead of saved money) is a bad idea in the long run, presumably, because having to pay off the interest on your debt decreases your ability to spend your way to greater aggregate demand (by decreasing both available credit and taking up a greater portion of government revenues).

That said, I realize that gold, silver, platinum, etc. do trade at prices above their intrinsic value. And, yes, coin-clipping was a problem, too, which can be ameliorated by issuing banknotes and coins backed by precious metals. Keeping the rate of inflation limited is better, in the long run, for almost everyone, but I will admit it is better for those who have fewer debts. However, wealth disparity in an era of greater inflation has increased, not decreased; inflation does transfer wealth from those with savings to those without, but it does not meaningfully reduce the ability of the very wealthy to get what they want, and preserve what they have. Strong working and middle classes are the foundation of a strong civilization, and constant inflationary monetary policy guts both of them by encouraging debt and wiping out savings (and investments) by prompting malinvestment-fueled economic downturns.

So while the present policies are good for the perennial debtor, and the people who profit from that debt, everyone in the middle is slowly being squeezed into one side or the other. And it’s not the profiting side for most of them.

Spoos: There’s also the fact that we don’t decrease spending in times of plenty, or increase taxes to pad a rainy-day fund.

You’re so right… Clinton never balanced a budget, and no surplus has ever been run in my lifetime.

Oh wait… he did, and we have; and “fiscal conservatives” who talk like you do blew it all.

As to infrastructure stimulus… who opposed it? Right, “fiscal conservatives” who talk like you do.

And the WPA, things like Hoover Dam, or the Interstate Highway system… never happened.

And when we were doing serious Keynesian policies, in the 1930s, it was arrested (based on the argument that “it had done its job already, and now we needed to cut spending to a “more sustainable level) by, “fiscal conservatives” who spoke like you. And the Depression returned.

Maybe the reason more Keynesian policies don’t get used is shitheads who hate the idea being treated as, “serious thinkers”.

Keeping the rate of inflation limited is better, in the long run, for almost everyone,

Until you come to the sort of thing we have now… A lower bound of zero. I’ll also argue it’s not, “better for everyone”. It’s better for rich people (who have sequestered something like 21 trillion dollars offshore to avoid being taxed on it; which is bad for the economy twice, but I digress), but it hurts those who aren’t rich; because it depresses wages.

Which depresses demand, which hurts everyone.

Strong working and middle classes are the foundation of a strong civilization,

Which your preferred way of running things destroys.

constant inflationary monetary policy guts both of them by encouraging debt and wiping out savings (and investments) by prompting malinvestment-fueled economic downturns.

Which is why we had such a terrible economy from 1945 to 1980. It’s why the latter ’80s and latter ’90s were such hellholes of ongoing depression.

You cited Japans, “lost generation”, while you ignored that Japan did exactly what the, “fiscal conservatives” are recommending now.

Why do you think it will work better here than there?

Keynes worked, it still works.

Anyone notice how Spoos was telling women a page or two back that they should be doing background checks on any potential partners?

I’ve never opposed infrastructure stimulus. I’m all for it, because it’s a better stimulus than tax cuts or subsidy of corporate losses, and helps build a foundation for renewed economic growth.

It is important to note that the Clinton surplus lasted four years, totaled slightly less than 560 billion dollars, and was bracketed on both sides by about 14 trillion dollars in deficit spending (presided over by both parties). True Keynesian policies would have the deficit average out to zero, yes?

The unregulated global economy is very helpful to the rich, and not so helpful to everyone else, agreed. That said, even if all that $21 trillion (a global, not U.S. figure) stayed at home, the rich aren’t really going to plow that money into anything other than making more money by value transference as opposed to value creation. Hence investment banking over industry. It will be very difficult to turn back the clock on that aspect of our economy, and it will be even more difficult to do so while inflation encourages a high debt load (which is mostly unrecoverable, but don’t expect the bankers to admit that). And then we subsidize gambling losses to prevent investors’ bad choices from dragging everyone down. But how do you end that?

The problem is that it doesn’t, and we are in an economically precarious place right now, especially if the “slightly less-sucky economy” bubble starts to take off. More irrational exuberance is the last thing we need.

I think most of our economic success from the 50’s onward was rooted in being the last industrialized country left with infrastructure not firebombed into the ground by World War II.

Japan’s lost generation came out of a liquidity- and inflation-fueled malinvestment crisis, sustained by propping up zombie firms that were “too big to fail”… gee, that sounds familiar.

That is stuff and nonsense and always has been:

On the history: the great postwar boom wasn’t just a few years after the war; it was a whole generation long, from 1947 to 1973 — well into an era in which Europe had very much recovered….The Europe-in-ruins era was long over while the US boom was still going strong.

But the bad history is incidental; the really key point is that this is nonsense economics. Yes, our competitors were in ruins for a while; so were our customers (who were more or less the same countries). Basically, we had nobody to trade with….

There’s a brief surge in exports in the late 1940s; that’s the Marshall Plan. But through the 50s and 60s America essentially did very little trade, exports or imports. If you think that’s good for the economy, you should be all for extreme protectionism.

Actually, there’s a substantial trade theory literature on the effect of other countries’ growth on our income and purchasing power, which says that it can go either way — more competition, but also bigger markets, with the net effect depending on how it affects our terms of trade, the ratio of export to import prices. There’s a slight presumption of positive effects from foreign growth, which becomes a much stronger presumption if the foreign economies start very small — which is exactly the situation after World War II. So the whole notion that we had it easy because Europe was destroyed is just ignorant.

And anyone who reflexively reaches for the idea that we were actually better off because Europe was in ruins as a way to explain the postwar economy should take a hard look in the mirror. Did you think this through? Or were you just grabbing for something, anything, to explain away a fact that your ideology says can’t have been true?

From the always quotable Paul Krugman.

You should click the link-he has graphs showing that your little theory is crap.

All of his “history” is crap. He’s going along on the “discrete” events sort of modelling; and ignoring outside events.

But GOLD! will fix everything… that and women being mindreaders and getting punished if they fail at avoiding dickwads.

I know, right? I’m not sure how it could be more obvious that Spoos is not really interested in dealing with the issue of families in poverty and government support. I mean, Spoos talks a good game about increasing access and affordability for birth control and everything. But that’s just preaching to the choir.

Apparently, these issues are going to be solved by internet hand-wringing and whining about silly, slutty women. And possibly cutting off benefits for poor children so that their silly, slutty mothers learn their lesson.

Ah, I like unions and progressive taxation. Keeping wage laborers from being exploited is in my economic interests, and keeping rich people from throwing too much money around in speculative boogaloos is in everyone’s economic interest. I don’t recall having disparaged either of those policies before.

Playing by free trade rules when other people are playing the mercantilists (e.g. China) is a loser’s game. Tariffs can be bad, but they can also level the playing field. I’d like to see tariffs aimed at boosting workers’ rights in places where economic competitiveness is obtained at a very high human cost. Ultimately, that would cut down on the cheap plastic crap I can buy, but I don’t need most of it, anyways.

How would having less of our country and people destroyed by war not be an economic advantage? I realize that post-WWII American economic growth continued well after Europe began to recover in the 60’s (likely helped in part by Johnson’s guns-and-butter spending), but it’s important that, post-Bretton-Woods, we started to stall out, with an ever-increasing trade deficit (which is also related to normalization of relations with China). We’re also faced with the price of oil (which ties into a whole lot of other prices) rising and becoming more volatile in large part because of the futures market; the oil shocks in the 70’s certainly didn’t help the American economy. We also got lazy and complacent, lowered marginal tax rates, frivolously overspent during peacetime, and deregulated large swaths of the financial industry which is a big part of the current mess.

I seem to have lost track of the point that you were making: I was not claiming that American prosperity in the 1950s was despite a high marginal tax rate, tariffs, and strong unions, which is the claim that Krugman seems to be debunking. Would you mind clarifying your copypasta?

Oh, anyone here read the part in Bush’s memoir when he notes that federal subsidy of risky mortgages helped precipitate the financial crisis? It was quite unexpectedly honest.

TL;DR BORED NOW.

Ok Spoos… tell us what you think will fix things. Not platitudes, the concrete steps/cuts/programs you’d like to see implemented.

Because, while you may not understand it, the comments you got, were responses to things you said, and ideas you presented.

@Dvärghundspossen – It was a study done in St. Louis over a 2 year period. The teen birth rate and abortion rates for the participants dropped like a rock with the availability of all forms of contraception, including the long-term implants which are not widely used across the country (cost and accessibility are big barriers to their use).

http://www.cbsnews.com/8301-204_162-57526550/study-free-birth-control-leads-to-way-fewer-abortions/

Actually it was a lie.

This report lays out exactly what happened and the main problem was as it always is when it comes to destroying the world market…private banks with no regulation.

Reading comprehension fail. The Professor was explaining that the argument the entire planet except the US was in smoldering ruins therefore the US was able to make lots and lots of money after the second world war was nonsense and here is why.

Aaaaaaargh. I have no head for economics, even when people are TRYING to make it easy to understand. Spoos is just giving me a headache.

As for the birth control thing… $20 to $50? Back when I was on it (admittedly very briefly, it made me nuts), it cost over $200 for a three-month supply! Fuck! And I had to go through a humiliating pelvic and anal exam to get it. (Which also cost me money.) Not for any health reasons, for liability. I WISH I could’ve just walked out and gotten it like condoms.

I still want to know if he’s lied to women to get them to sleep with him, or if he just hangs out with guys who do.

@emilygoddess: Nope, never lied for sex, and I have no friends because I’m a virgin keyboard-jockey. Those PUA/MRA/AlphabetSoup guys, amirite?

I neither hang out with men who lie for sex, nor lie for sex myself. I wouldn’t want someone to have sex with me under false pretenses, so I wouldn’t feel comfortable lying to get sex. Your question got buried up-thread, and I lost track of it.

@pecunium: Specific policies?

Return of the capital gains tax to pre-Reagan rates, repealing the Bush tax cuts for those making more than $500,000 a year, inflation under one percent per annum, a balanced federal budget in four years, to include payments on the principal of the national debt within eight, with a goal to have paid the debt in full by the end of the century.

A sharp curtailing of additional welfare benefits for having more children, government subsidy of birth control (up to a free implant or IUD for current TANF, SNAP, and WIC recipients; paying for male birth control equivalents or elective vasectomies would also be reasonable) either risk-based premiums for a national health service or a full privatization and repeal of EMTALA, and paring back the fungibility of government benefits to reduce illegal sales.

Stricter regulations on investment banking, prosecutions of those responsible for the 2008 collapse, full nationalization of any bank receiving a future federal bailout, and a slow move to a bimetallic monetary standard, to be accomplished gradually over 50 years.

An amendment to the Constitution prohibiting borrowing from foreign creditors, a drawdown of American military presence abroad, a reduction in the size of the active-duty Army, as well as the Reserve, and an end to cost-plus no-bid defense contracts.

Every American should be able to serve for a year or longer in a program such as Americorps or in the National Guard and receive partial tuition benefits for their service, student loans should be dischargeable in bankruptcy, and performance and aptitude tests should be made a permissible part of hiring decisions.

The National Guard should not be deployed overseas, but rather used to secure the borders and as a militia in the even of an attack on the United States; following border closing, a gradual drawdown of H1B visas, deportation of illegal aliens with violent misdemeanor or felony convictions, and a path to residence without citizenship for the remainder.

Lastly, raising import tariffs to correct for currency debasement and lack of workers’ rights in U.S. trade partners, to be adjusted based on the policies of the nation in question.

I may have missed a few things, but that’s a start, at least. And, yes, I’m aware none of that is likely to happen.

So why all the PUA lingo on your blog?

You do realize that welfare for extra kids isn’t exactly hitting the lottery, don’t you? It’s so cute when middle class conservative white dudes try to put their morality to everyone else.

The rest of your teal deer is a steaming pile of fucked-up as well.

HAHAHAHAHAHA!